What Kinds of Loans Can a Businessman Avail?

Running a business means you’re always juggling finances – whether you’re just starting out, trying to grow, or need funds to handle everyday expenses.

Sometimes, no matter how well things are going, you need a little extra financial help to keep things moving smoothly or take your business to the next level.

That’s where loans come in.

For businessmen, there are all sorts of loans available, each designed for different situations.

So, let’s talk about the kinds of loans you can tap into, depending on what your business needs.

1.

Overdraft An overdraft lets you withdraw more money from your account than what’s currently in it, up to a set limit.

This option is great for businesses that face unpredictable cash flow.

2.

Term Loans A term loan gives you a lump sum of money that you pay back in regular instalments over a set period.

The fixed repayment schedule helps you plan your finances.

3.

Letter of Credit A letter of credit is a financial tool often used in international trade.

It guarantees that a seller gets paid even if the buyer can’t make the payment.

It’s most useful for companies that are regularly involved in importing and exporting goods.

4.

Cash Credit Cash credit lets you borrow against the value of your stock or receivables.

It’s a great way to keep your business running smoothly by covering day-to-day expenses.

This is useful for businesses that have fluctuating cash flows.

5.

Business Loan against Property Here, you can use your property as collateral to get a loan.

It’s a good option if you need a significant amount of money to expand your business.

However, the risk is that if you can’t repay the loan, you could lose your property.

This loan is best for businesses that need a lot of capital and have property to back it up.

6.

Invoice Factoring With invoice factoring, you sell your unpaid invoices to a lender for immediate cash.

This is helpful if your business has lots of invoices with long payment terms.

The lender pays you a portion of the invoice amount upfront and collects the payment directly from your customer.

7.

Startup Loan A startup loan is designed to help new businesses get off the ground.

It can cover everything from initial setup costs to marketing and product development.

They provide a crucial financial boost for entrepreneurs.

These loans are perfect for businesses that need a financial foundation without offering much security.

8.

Personal Loan A personal loan can be used for business purposes when you need quick funding and don’t want to deal with complicated loan applications.

Since it’s a personal loan, there’s no need to pledge business assets as collateral.

9.

Project Loans Project loans are designed to fund large-scale business projects, like new infrastructure, manufacturing plants or other major ventures.

They provide significant funding, suitable for long-term projects that need substantial capital.

10.

Unsecured Business Loan An unsecured business loan doesn’t require any collateral, meaning you don’t have to put up property or assets to get the loan.

It is suitable for smaller amounts.

They’re a great option if you need quick access to funds but don’t want to risk your assets.

Small finance banks are a great option for businesses that need quick, flexible loans.

They’re easier to work with, offering faster approvals and serving smaller companies, startups and rural businesses.

If you’re looking for accessible financial support tailored to your needs, small finance banks are a smart choice.

Explore your options with Unity Small Finance Bank for online loan applications, including secured and unsecured business loans.

Discover their flexible repayment terms and quick approvals that can take your business to the next level.

.

Related Articles

business

India’s spice exports set to hit $10 bn by 2030, eyes growth in new global markets

November 14, 2024

Indian spices export market is expected to grow to $10 billion by 2030 for which the spices industry is looking to expand its footprint in Africa, South America, and the East European bloc, where its presence is not yet significant, according to Ramkumar Menon, chairman of World Spice Organisation (WSO).

In an interaction with ET, Menon said “Besides exploring new markets, the spice industry is focusing on emerging sectors like health and wellness, nutraceuticals, and pharma, where spices are major ingredients owing to their health benefits.

read morebusiness

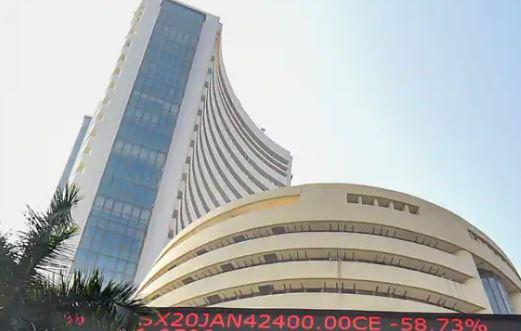

Sensex drops 110pts, Nifty falls for 6th day on FII selling, inflationary concerns

November 14, 2024

Mumbai: Benchmark Sensex declined by 110 points in a see-saw trade Thursday, marking its third straight session of losses amid continued FII selling, disappointing quarterly results and soaring inflation.

Benchmark BSE Sensex dropped 110.

read more